It’s relatively well-known that after a sufficiently long enough period, a stock portfolio leaning toward businesses with lower market caps would beat the overall S&P 500. To qualify as a small-cap stock, the firm’s market cap should be over $300 million but less than $2 billion. Small caps are most popular with investors when there’s room to grow. These stocks represent businesses that perhaps haven’t fully realized the scope of their abilities or potential; such would be the case with many young companies.

Small-cap stocks offer high growth potential in the public marketplace but are more unpredictable than their large- and mega-cap counterparts. Favorites such as big-name retailers and mega-cap tech stocks tend to move more in sync with the market as a whole regarding pricing. Small caps are distinct but aren’t easy to dismiss, especially when exercising caution with one’s portfolio by seeking safe, affordable options. A stock’s performance, combined with the level of investor interest, significantly impacts its stock price more than the company’s size. In today’s environment, the attitude of many is one of mild skepticism when choosing individual portfolio additions. It’s pretty easy to understand, so it certainly brings peace of mind when the experts are bullish, with the numbers in place to back it up.

With that said, the essential pieces of info represent not where these stocks have been but where they’re headed. For each, there is a significant potential upside, and the expert analysts are urging investors to buy these tickers now:

Avidity Biosciences Inc (RNA)

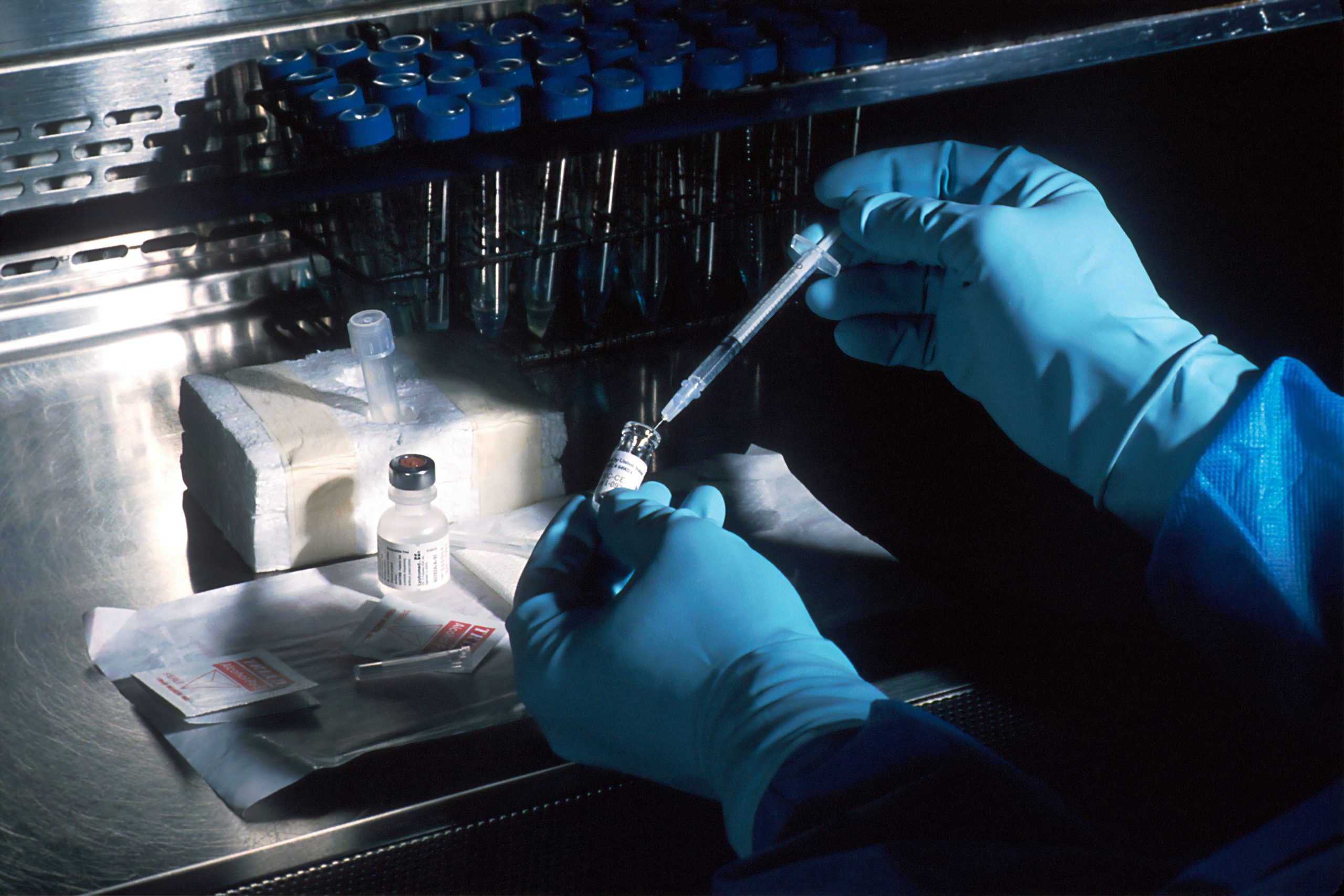

Avidity Biosciences Inc (RNA) is a relatively young and modest biopharmaceutical company with under 200 employees. RNA focuses on the research and development of antibody oligonucleotide conjugates (AOC) for various disorders, primarily including rare muscular ailments such as myotonic dystrophy type 1, Duchenne muscular dystrophy, and facioscapulohumeral muscular dystrophy. These conditions are studied under clinical trials conducted by RNA, with safe and effective treatment and therapy for its patients being the priority. RNA was founded in 2012, and its headquarters are in San Diego, CA.

RNA is innovative in the lab, but its stock has only recently managed to pick itself up, having dealt with a rocky FY2022. With a market cap of just over $1.6 billion, RNA has brought in $9.22 million in revenue over the last 12 months, with year-over-year revenue growth of 49.51%. Despite the bumps, RNA beat analysts’ earnings projections for the previous two quarters, and it has a 34% price increase to start Q12023. The current quarter shows RNA with $2 million in sales; the stock is up slightly year-to-date. Reporting earnings again in May and is only expected to grow from there, more Wall Street analysts are increasingly bullish about RNA. Analysts who offer yearly price forecasts have given RNA a median price target of $35, with a high of $71 and a low of $27. RNA hitting its median would bring a 54.5% increase, while reaching the high end of its price range would yield a stunning 213.5% leap over current pricing. All the analysts who’ve been studying RNA agree on its buy rating.

Arcos Dorados Holdings Inc (ARCO)

Arcos Dorados Holdings Inc (ARCO) is an active McDonald’s franchisee with over 2,140 locations. ARCO operates in four regions: Brazil, the Caribbean, North Latin America (NOLAD), which includes Mexico, Costa Rica, and Panama, and South Latin America (SLAD), which includes Argentina, Peru, Chile, Ecuador, and Uruguay. ARCO’s menus have basic options such as Almuerzos Colombianos (Colombian Lunches) in Colombia and core items like the Big Mac, Quarter Pounder, and Happy Meal. ARCO even brings premium options like MCD’s Angus premium beef. ARCO was founded on August 3rd, 2007, and is headquartered in Uruguay, Buenos Aires, Argentina.

ARCO most recently beat analysts’ EPS projections by a whopping margin of 127.75%. ARCO is positioned to bring in $1 billion in sales for the current quarter, with an EPS of 23 cents per share. ARCO has a volatility-safe beta figure of 0.98, a P/E ratio of 13.12x, a forward P/E of 12.28x, and a 3-5 year EPS growth of 3.5%. ARCO has reported roughly $3.38 billion in revenue over the last twelve months, substantially higher than its market cap of $1.73 billion. ARCO has an ROE (return on equity) of 61.46% and shows healthy year-over-year growth in all critical areas. ARCO has a modest dividend yield of 0.49% and a quarterly payout of 3 cents per share. Analysts who offer 12-month pricing estimates give ARCO a median price target of $10.30, with a high of $12 and a low of $9. The median price estimate represents a 25% increase from its current price, its high mark indicating a 45.6% increase, and it’s not difficult to see why it’s buy-rated.

Franklin Covey Co (FC)

Franklin Covey Co (FC) has a global impact on the field of education, which is its specialty and primary focus. Most of FC‘s earnings come from training and consulting services, internal reporting, and operating frameworks. FC’s Direct Office division comprises book and audiobook sellers, government services, and personnel. The International Licensee division contains FC licensees which span the globe. FC incorporates domestic and international initiatives in its educational approach and also deals with shipping, handling, and leasing. FC was founded in 1983, and its headquarters are in Salt Lake City, UT.

Like its peers, FC is an attractive stock for multiple reasons. FC has brought more bulls to the table as it has displayed an impressive recovery from the pandemic, especially considering its size. FC has beaten analysts’ earnings projections for the last six consecutive quarters. FC’s trailing twelve-month numbers show revenue of $270 million, a gross profit margin of 76.42%, a debt-to-equity of 24.85%, an ROE of 22.47%, with an EPS of $1.32 per share, and a 3-5 year EPS growth rate of 9.2%. FC carries a market cap of roughly $657 million and is forecasted to report $62.4 million in sales for the current quarter at 13 cents per share. Analysts who provide annual price forecasts have weighed in, giving FC a median price target of $71, with a high of $100 and a low of $60. The average price target suggests an upside of 50.2% while reaching the high end of FC’s price range would mean a massive 111.6% increase over current pricing. Even the low would bring FC up by 27%, an upside that generally wouldn’t be found with large-cap stocks. Stock analysts also concede fully on FC’s robust buy rating.

Read Next – Obama Back in the White House?

Obama is back?

Just take a look at the new weapon Biden is unleashing upon American citizens.

It’s actually something Obama originally pushed forward.

and then

and then