While the fiscal year is not over for many businesses — and it’s important to make that distinction — I can relate if one’s resolutions are financially linked. A poll was taken recently, which showed that more than half of U.S. citizens who volunteered their “new year’s resolution” had pledged to focus on finances. Given that we have headed (or are heading) out of 2022, on record as the worst year for the stock market since 2008, I can understand someone erring on the side of caution and doing what yields comfort. Having gaur dividends happens to be a comfortable move for some investors.

Healthcare firms, major banks, retailers, and mega-cap tech (to keep things fun) comprise the Dow 30. The Dow took a hit in 2022, just as the Nasdaq and S&P 500 did: Nasdaq ended the year down by 33.1% from January, S&P 500 ended down by 19.4% for the year, while Dow Jones ended down 8.8%. Technically speaking, the Dow had the least poor performance of the three. I then remembered that most of the Dow’s thirty noteworthy equities not only paid lucrative dividends but represented solid businesses. While a dividend-paying stock does not guarantee against the unforeseen, it can offer peace of mind through its income to shareholders, especially when a great company is behind it.

Accounting for what I typically seek, I’ll include some additional market measures that will help us. The experts concede on buying and holding these large dividend-paying tickers:

Merck & Co Inc (MRK)

Merck & Co, Inc (MRK) is a global healthcare firm aiming to treat humans and animals. MRK’s pharmaceutical business provides human health pharmacological products in cancer, neurology, acute hospital care, cardiology, immunology, virology, diabetes therapy, and vaccines. MRK’s Animal Health division creates, produces, and sells veterinary medications, vaccinations, health management systems, and monitoring equipment that are digitally connected. MRK’s customers include drug wholesalers and retailers, hospitals, and government agencies. MRK collaborates with Bayer, AstraZeneca, Ridgeback Biotherapeutics, and Gilead Sciences to commercialize long-acting HIV treatments. MRK was established in 1891 and is based in Kenilworth, NJ.

MRK’s stock is down by almost 45% year-to-date, and it’s hard to see why. For the current fiscal quarter, MRK shows forecasted revenue of $13.7 billion at a quarterly EPS of $1.53 per share. MRK sports a market cap of $281 billion and recently reported quarterly sales of $14.96 billion, charging past analysts’ predictions. MRK has a beta score of 0.40, making it less prone to volatility. I’ll work off the TTM (trailing twelve months) measurement to reconcile the fiscal year with the Gregorian calendar. MRK shows revenue of $59 billion (at $6.04 per share), a P/E ratio of 18.38x, a return on equity margin of 38.18%, a gross profit margin of 70.85%, and a net margin of 26%. MRK has a 2.63% dividend yield, with a quarterly shareholder payout of 73 cents ($2.92/year) per share. Analysts who offer annual pricing projections give MRK a consensus median price target of $110, with a high of $135 and a low of $100. MRK could see an increase of 21.75%. Analysts are telling us to Buy Now and Hold.

JPMorgan Chase & Co (JPM)

JPMorgan Chase & Co (JPM) is a global financial services corporation with a vast network of operations. JPM‘s CCB business segment provides investing and banking products, transactions, and other services such as mortgage lending and home equity financing. JPM’s CIB section offers investment banking products and services such as company strategy and structure advising, equity and debt market capital-raising, risk mitigation solutions, and research. JPM works with big and midsized businesses, municipal governments, and charitable organizations. In addition, JPM offers ATM, internet, mobile, and telephonic banking services. JPM was established in 1799 and is based in New York, NY

JPM, priced down by 15.20% year-to-date, shows the kinds of metrics you’d expect from an almost $400 billion market-cap banking behemoth. Per JPM’s trailing twelve months, it beat analysts’ quarterly earnings projections consecutively; most recently, JPM’s EPS of $3.12 vs. the $2.86 expected was a +9.18% win, and JPM reported revenue of $32.72 billion, a 2.62% surprise. JPM shows revenue of $74.7 billion with an EPS of $11.84. JPM has a P/E ratio of 11.32x, a PEG ratio of 1.12x, and a net profit margin of 37.04%. JPM currently has a dividend yield of 2.98%, with a quarterly payout of $1.00 ($4/year) per share. Analysts have given JPM a consensus median price target of $146.50, with a high of $169 and a low of $118. The estimate indicates a 9.23% increase in JPM’s price, with a total upswing potential of +26%. The economists’ consensus gives JPM a buy rating, recommending that we hold.

Johnson & Johnson (JNJ)

Johnson & Johnson (JNJ) is a global leader in health-related goods and services with vast operational abilities. JNJ researches, produces and distributes a wide range of healthcare items. JNJ‘s Consumer Health sector sells infant care goods under the Johnson’s and Aveeno brands and oral care items under the Listerine brand. Pharmaceuticals are available from JNJ for rheumatoid arthritis, inflammatory bowel disease, and HIV/AIDS infections. JNJ can also treat prostate, lung, and bladder cancer. JNJ provides a prescription service to retailers, hospitals, and specialists. JNJ offers solutions for surgical procedures ranging from breast augmentation to ear, nose, and throat operations. JNJ was established in 1886 and is headquartered in New Brunswick, NJ.

I always knew the name of the baby powder. Now, JNJ is recognized as a pioneer during the early stages of the pandemic. JNJ has a beta score of 0.56, good protection with a market cap of $461 billion. JNJ has forecasted present-quarter sales of $23.9 billion at $2.23 per share. Per its trailing twelve months (TTM), JNJ is operating with $96 billion in revenue, EPS of $7.18 per share, a P/E ratio of 24.5x, a return on equity of 26.45%, return on capital of 20.38%, a gross profit margin of 67.48%, and a net margin hovering right at 20% (while the industry average is 8.6%). JNJ has a D/E (Debt to Equity) figure of 40.51. JNJ has a current dividend yield of 2.56%, with a quarterly payout of $1.13 ($4.52/year) per share. Analysts have given JNJ a consensus median price target of $180.50, with a high of $215 and a low of $160. This estimate represents a potential jump of 21.17% from current pricing. There’s no contest in regards to any rating less than hold. So, the cue on JNJ? The experts tell us to Buy Now and Hold.

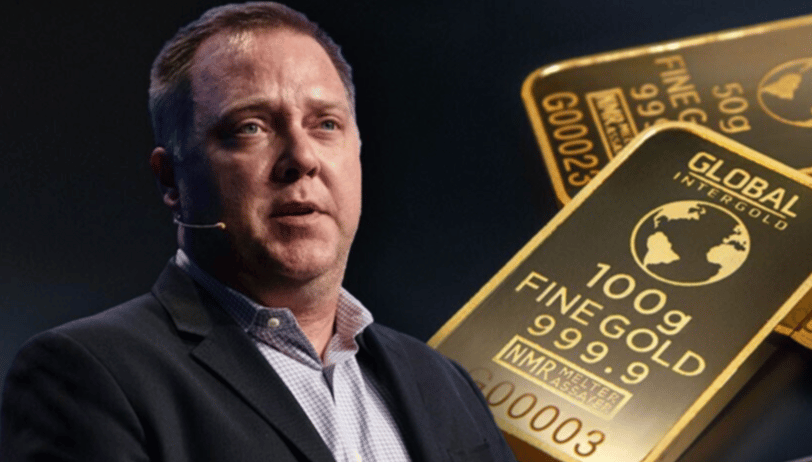

Read Next – Gold Breakout ALERT

Gold hit $1,800 last week…

That’s the highest level in months.

But this compelling research shows why gold could jump EVEN HIGHER.

In fact, some now believe gold could soar to $3,000 in the coming weeks.

Meaning if you’re starting to wonder whether you should add gold to your portfolio right now, you need to check this story out immediately.

Don’t forget…

The macroeconomic picture is still not pretty: Consumer confidence is dropping… home prices and home sales are plummeting… all while layoffs soared 127% just in November alone.

But as you’ll see, there’s an even BIGGER catalyst brewing for gold right now – one that most Americans are completely overlooking.

In fact, one mysterious buyer has been quietly hoarding gold at the fastest pace in 55 years.

Click here for the full story… including the No. 1 way to get in on gold today (for less than $6).

and then

and then