When Warren Buffett speaks, Wall Street and the investing community wisely listen. That’s because the Oracle of Omaha has been a money machine since becoming CEO of Berkshire Hathaway(BRK.A -1.18%) (BRK.B -1.16%) in 1965. Over 57 years, he’s created more than $660 billion in value for shareholders (including himself), and delivered an aggregate return for the company’s Class A shares (BRK.A) that exceeds 3,600,000%, through Dec. 31, 2021.

In other words, Warren Buffett knows a thing or two about picking winners over the long run.

With both the benchmark S&P 500 and growth-driven Nasdaq Composite falling into a bear market this year, deals abound — and that includes within Buffett’s portfolio. The following three Warren Buffett stocks can all be confidently bought hand over fist by patient investors in April.

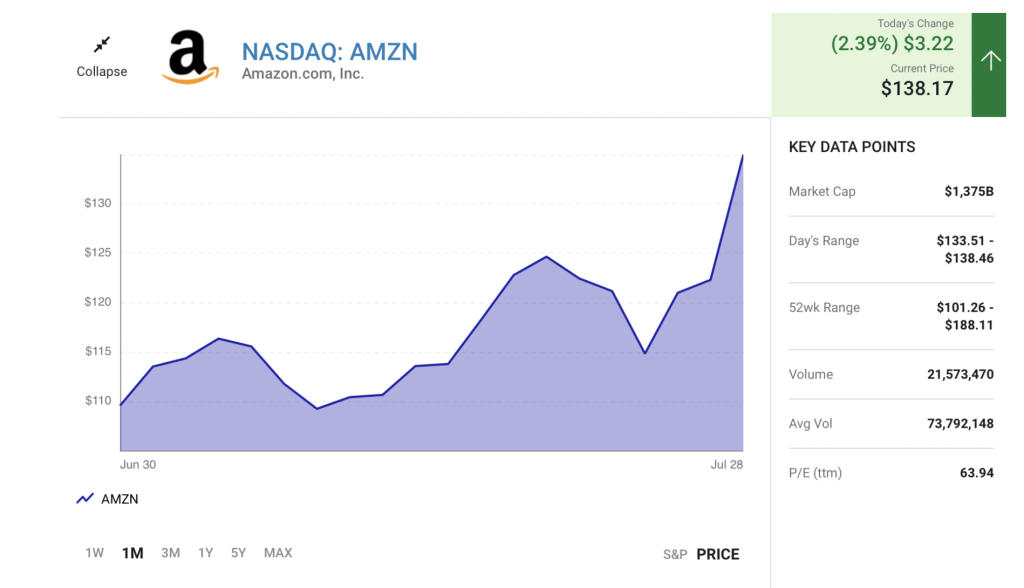

Amazon

The first Buffett stock that’s begging to be bought by long-term investors in August is e-commerce behemoth Amazon (AMZN 2.39%). Even though it’s bounced well off of its lows, Amazon is still an incredible value, relative to the premium Wall Street has assigned it for more than a decade.

The prevailing concern for the online retail sales giant is that U.S. is in a recession, or headed that way. Retailers usually take it on the chin when the U.S. economy contracts, with margins contracting and inventory rising. However, there’s a lot more to Amazon than just its leading e-commerce marketplace.

For most people, their familiarity with Amazon is entirely tied to its online presence. According to a March 2022 report from eMarketer, Amazon is estimated to bring in 39.5% of U.S. online retail sales this year. For context, that’s higher share than its 14 closest competitors on a combined basis. This means the company’s lead in online retail sales is exceptionally safe.

But when push comes to shove, retail sales represents a low-margin operating segment for Amazon. What’s been far more important are the company’s ancillary segments, as well as the additional business its e-commerce platform has brought the company.

As an example, Amazon has signed up more than 200 million people worldwide to a Prime membership. In return for small perks given to Prime members (e.g., free delivery and exclusive streaming content), Amazon collects tens of billions of dollars in subscription revenue, which it can use for its logistics network, to undercut brick-and-mortar retailers on price, or to reinvest in higher-margin initiatives.

Speaking of higher-margin initiatives, cloud infrastructure service segment Amazon Web Services (AWS) looks unstoppable. AWS accounted for 33% of all cloud service spending in the first quarter, based on an estimate from Canalys, and AWS managed 33% year-over-year revenue growth during an exceptionally challenging second quarter.

Throughout the 2010’s, investors gladly paid up to 37 times Amazon’s year-end operating cash flow to buy shares. Investors can buy those same shares today for a little over 9 times Wall Street’s forecast cash flow for 2025.

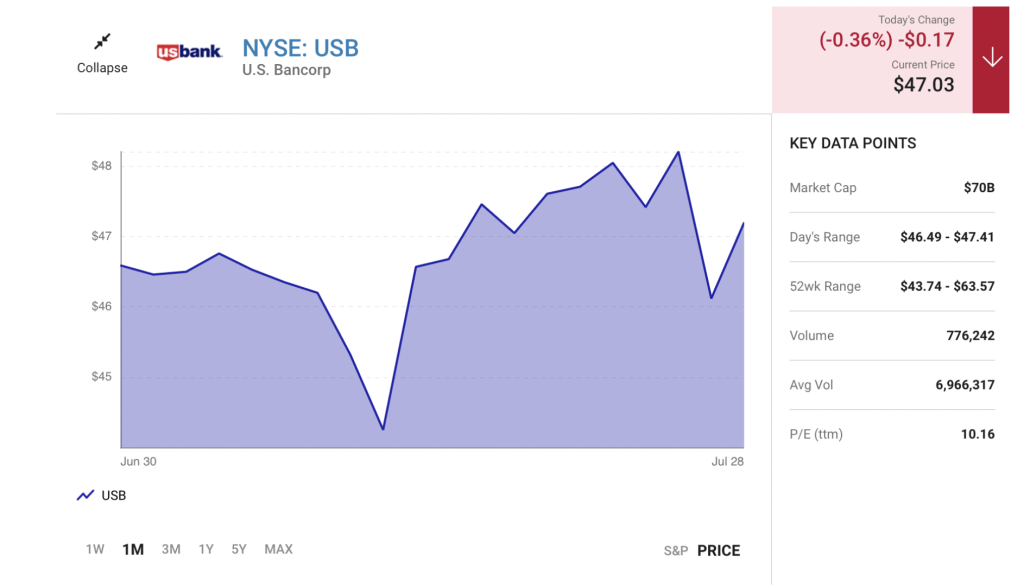

U.S. Bancorp

A second Warren Buffett stock that can be confidently bought hand over fist as we steam into August is regional banking giant U.S. Bancorp (USB -0.36%), which is the parent of the more familiar U.S. Bank.

The big concern for bank stocks is their cyclical ties. Companies that are cyclical fire on all cylinders when the U.S. economy is growing, and often struggle when economic contractions or recessions arise. With the U.S. economy contracting in two consecutive quarters — 1.6% in the first quarter and 0.9% in the second quarter, based on initial estimates — there’s a reasonable likelihood that U.S. Bancorp will see higher loan delinquencies and possibly charge-offs in the coming quarters.

However, there are two sides to businesses being cyclical. Even though recessions are an inevitable part of the economic cycle, they usually last for just a couple of quarters. By comparison, periods of expansion are almost always measured in years. Disproportionately longer periods of expansion allow banks to grow their loans and deposits to take advantage of the long-term expansion of the U.S. economy.

Another reason patient investors can scoop up shares of U.S. Bancorp is the company’s fiscally prudent management team. Whereas money-center banks got themselves into trouble by making risky derivative investments prior to the Great Recession (2007-2009), U.S. Bancorp has avoided these pitfalls and primarily stuck to the bread-and-butter of banking: growing its loans and deposits. This is why U.S. Bancorp bounces back from economic downturns much faster than its peers.

What’s more, we’re hitting the sweet spot for bank stocks. With inflation screaming to a four-decade high of 9.1% in June 2022, the Federal Reserve has no choice but to aggressively raise interest rates. Banks benefit by collecting extra net-interest income on all of their outstanding variable-rate loans. Even if loan delinquencies rise a bit, the added net-interest income collected as a result of central bank rate hikes should lead to significant earnings expansion.

If you need one more reason to be enamored with U.S. Bancorp this August, let it be the company’s digital engagement trends. Perhaps no big bank has been more successful encouraging its customers to bank digitally (online or via mobile app). As of the end of May 2022, 82% of its active customers were banking digitally, with 64% completing loan sales online or via app. The latter is up from just 45% at the beginning of 2020. Digital transactions are considerably cheaper for banks and help improve their operating efficiency.

Valued at roughly 9 times Wall Street’s forecast earnings for 2023, U.S. Bancorp looks like an absolute steal.

Visa

The third Warren Buffett stock to buy hand over fist in August is none other than payment processor Visa(V -0.41%).

To echo the concerns with both Amazon and U.S. Bancorp, Visa is a cyclical business. Therefore, Wall Street and investors are concerned about consumer and enterprise spending in the near-term. If consumers and business spend less, Visa’s fee-driven operating model will collect less revenue and (likely) generate lower profits.

However, betting against Visa has been a fool’s gamble for more than a decade for a variety of reasons.

To begin with, being cyclical isn’t a bad thing. Since economic expansions last years, Visa is able to easily navigate downturns that usually last less than a year. As the U.S. and global economy grow over time, so does Visa’s ability to rake in processing fees and add merchants to its payment network.

Read next – My Top Dividend Stock of 2023

America’s top income strategist just went live with an urgent message for investors.

He’s identified the top dividend stock for the remainder of 2023…

A stock he’s convinced is your best chance to fight back against rising inflation and a looming recession.

With a massive 14% yield, this stock has been so consistent with its payouts he calls it his

“Sure Thing.”

And he’s prepared to share it with you today … absolutely FREE.

What’s more, he’s prepared to send you 4 additional inflation busting dividend stocks with the potential to increase your income every year without investing a single penny more!

He’s put it all together in a FREE package he calls the Income Forever Bundle.

It includes his brand-new book that’s packed with income tricks, tips and secrets he’s acquired over 20 years of helping independent investors achieve financial freedom.

But this is a limited time offer, so click here to claim your FREE Income Forever Bundle today.

and then

and then